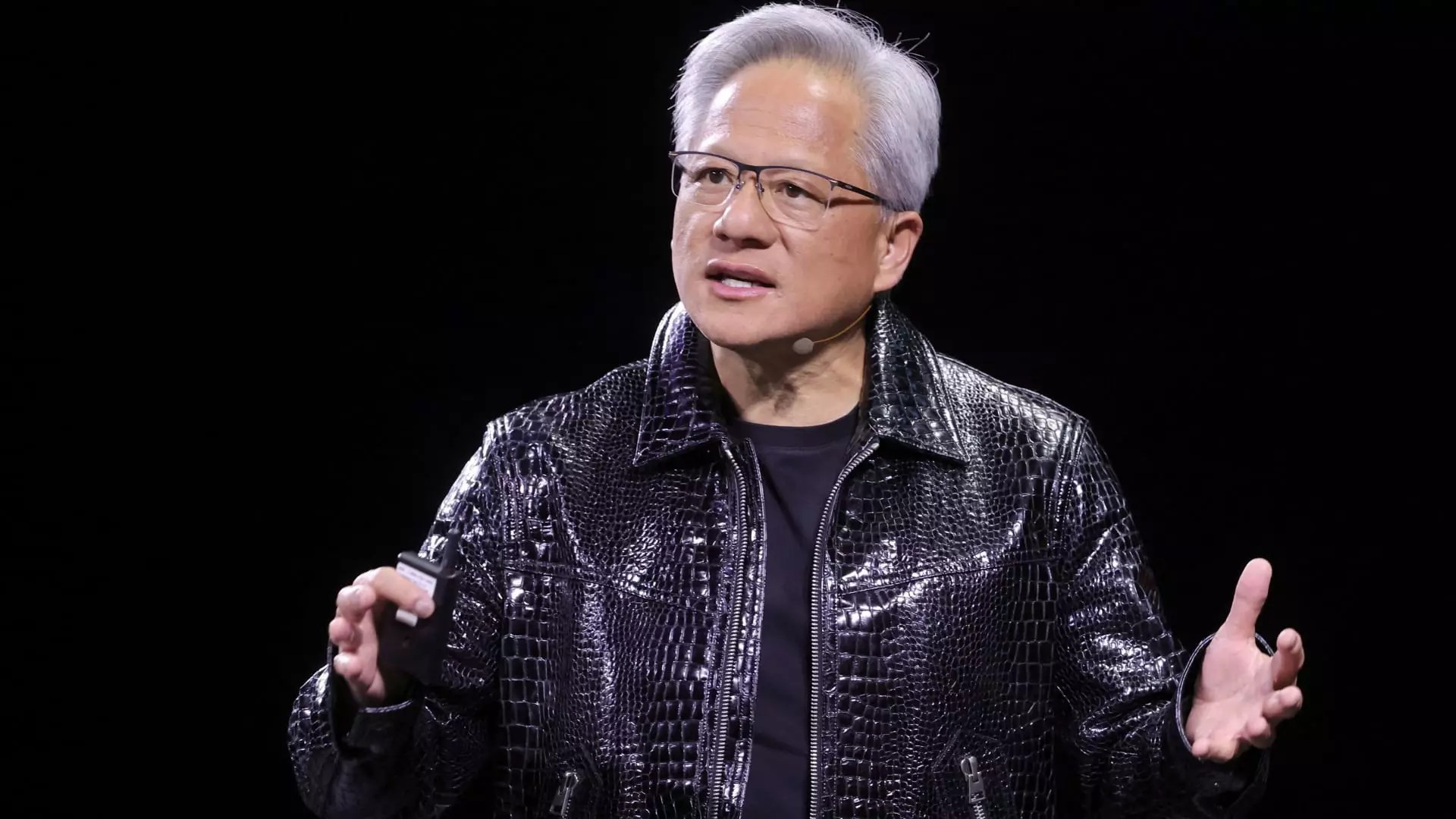

In a recent event that was anticipated to reignite enthusiasm around the beleaguered quantum computing sector, Nvidia’s CEO Jensen Huang may have inadvertently dampened the spirits of investors instead. His intention to clarify earlier comments about the timeline for useful quantum computers ended up eliciting skepticism rather than confidence. Contrary to his hopes, stocks across the quantum landscape, including major players like D-Wave and IonQ, suffered significant losses following his statements. This irony raises a legitimate question: Can executives truly gauge the complex sentiment of the market?

Huang had suggested in January that quantum computing might need at least 15 years to become commercially viable. However, this week’s attempt at re-framing those comments was unconvincing. Huang’s observation that this was “the first event in history where a company CEO invites all of the guests to explain why he was wrong” portrays a lack of acknowledgment of the gravity of his previous statement, as well as its market impact. This lack of accountability undermines confidence in both Huang and Nvidia, raising doubts about whether the vision articulated by tech titans can ever materialize.

Mixed Signals from the Quantum Sphere

Even as Huang hosted what he termed “Quantum Day,” featuring executives from various quantum firms, the overall sentiment remained one of uncertainty. While Huang attempted to redefine the narrative around quantum computing, suggesting it should be viewed as a complementary tool to classical computing rather than a revolutionary replacement, his remarks failed to assuage investor fears. There’s a profound disconnect here; tech executives often speak in grand visions, but when in the weeds of investment, clarity and dependability are what truly matter.

Quinn Bolton, an analyst at Needham, pointed out that Huang’s remarks concerning the branding of quantum computing were particularly contentious. While aiming to reposition quantum as a specialized tool, Huang ended up fanning the flames of skepticism instead of calming them. In an industry that hinges on innovation, the very notion that quantum should be marketed as anything less than transformative is perplexing. This hesitation reflects poorly on the vision for the future of quantum technology and raises broader questions about Nvidia’s long-term strategy in this arena.

The Influence of Tech Giants on Market Sentiment

As one of the leading players in the semiconductor and AI space, Nvidia holds considerable sway over not just its own stock, but also over the emerging quantum field. Huang’s ability—and perhaps the inability—to gauge market responses can have cascading effects across the whole sector. His comments have the power to ignite shifts in perception, both positively and negatively. This paradox highlights a troubling aspect of corporate leadership in emerging industries: the blurry line between vision-laden inspiration and palpable reality.

However, even amidst the turmoil, Huang did express optimism regarding the potential of quantum computing to deliver monumental advancements, mentioning new research initiatives such as the forthcoming center in Boston. The irony is palpable; while Nvidia stands to gain from advancements in quantum tech, Huang’s attempts to inspire confidence come across as too ambivalent and vague. His dual role as both a promoter of advancement and a cautious navigator of market sentiment puts him in a challenging spot.

The Wider Consequences of Inaccurate Projections

The fallout from Huang’s statements is a stark reminder of the implications that come with inexact timelines and high expectations. Not only do they lead to market volatility, but they also stifle innovation in a sector that bespeaks the future of computational capacities. Investors, shaken by fluctuating messages, question their confidence in the potential of quantum computing. The unstable trajectory of the Quantum Defiance ETF—a visible marker of this conflict—demonstrates a sector on the precipice, caught between powerful aspirations and the sobering weight of reality.

For shareholders, the potential of quantum computing is both a beacon of hope and a source of concern. The hallowed promise of quantum remains tantalizingly just out of reach. Investors are not just looking for tech trends; they’re searching for solidity and verifiable pathways from visionary leaders—paths that, at the moment, do not seem clear. A tech-driven future hinges on clarity and commitment, and for Julia and companies like Nvidia, striking the right balance between ambition and realism will be paramount as the quantum saga unfolds.

Leave a Reply