The ongoing discussions surrounding the One Big Beautiful Bill Act (OBBBA) highlight a fundamental flaw in how lawmakers approach tax policy. The House’s recent move to raise the state and local tax (SALT) deduction cap from $10,000 to $40,000 was purportedly designed to appease Republican representatives from high-tax states. However, these adjustments merely skim the surface, failing to address deeper systemic issues within our tax framework. The illusion of fiscal responsibility is enticing, but the underlying reality reveals that such a move could not only exacerbate the deficit but also create a dependency on flawed tax policies.

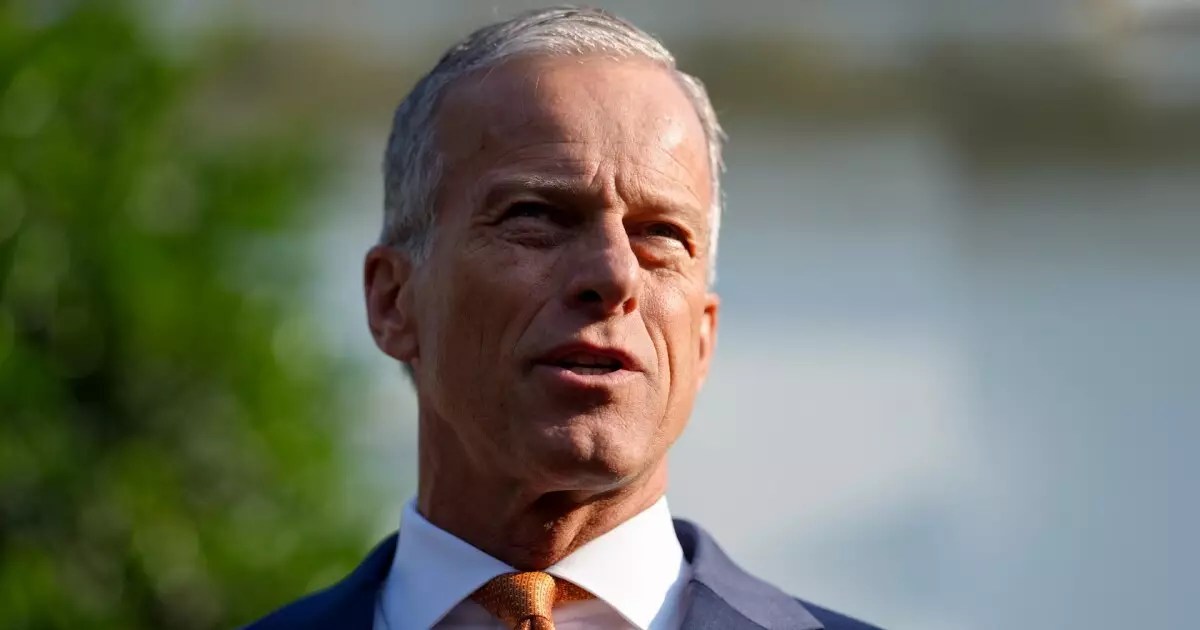

A Senate Stalwart’s Dismissive Tone

Senate Majority Leader John Thune’s dismissal of the SALT cap issue during a recent press conference should raise alarm bells. His assertion that “there really isn’t a single Republican senator who cares much about the SALT issue” reveals a shocking lack of sensitivity to the nuances of tax equity for citizens across different states. While it’s easy for members from states with lower tax burdens to adopt a cavalier attitude, it is incumbent upon legislators to examine how tax policies disproportionately affect different demographics. The decision to prioritize political expediency over actual fiscal responsibility reflects a worrying trend in governance.

Where are the Republican Voices from Blue States?

The glaring absence of Republican Senators from traditionally blue states—New York, New Jersey, and California—is significant in shaping the SALT debate. It plays into a larger narrative where only the voices from low-tax states dominate discussions around taxation. As Mike Crapo, chair of the Senate Finance Committee, noted, the concerns of voters in high-tax areas are regularly overlooked due to a lack of representation. This geographical bias distorts our understanding of tax policy impacts, limiting discussions to those most privileged by a system that prioritizes their interests.

A Band-Aid on a Budget Wound

The figures attached to the proposed tax cuts raise critical concerns that demand closer scrutiny. With over $4 trillion in tax cuts and an anticipated budget deficit of approximately $2.6 trillion over the next decade, an immediate question arises—how can lawmakers defend such fiscal irresponsibility? Garrett Watson from the Tax Foundation aptly highlights the “math problem” that the House bill faces. Surface-level fixes, such as adjusting the SALT cap, fail to recognize that substantive tax reform requires a thoughtful approach that avoids exacerbating our national debt.

Municipal Bonds: Caught in the Crossfire

The SALT cap’s overhaul also poses a threat to the future of municipal bonds—a crucial funding mechanism for local infrastructure. Advocates for lifting the cap argue that it empowers municipalities to generate revenue through local taxes, yet this perspective overlooks the consequences of increased fiscal burdens on taxpayers. Regulatory changes may infringe on the viability of tax-exempt municipal bonds, which serve as essential tools for public investment. Brett Bolton from the Bond Dealers of America rightly points out that significant alterations lie ahead, further complicating this already convoluted process.

Unrealistic Expectations and Fragile Reforms

The proposed changes to the SALT deduction ironically serve to entrench the very issues that lawmakers aim to mitigate. While the House’s intention may be to foster a sense of cooperation for the OBBBA, the reality is that weaker provisions can lead to missed opportunities for holistic tax reform. The existence of pass-through exemptions for business owners illustrates this paradox; while they may present a temporary relief for some, these workarounds ultimately undermine a coherent tax policy. If the House’s increased SALT cap becomes law, we can expect the potential obsolescence of existing tax mitigation strategies like PTEs, as experts fear the once-functioning mechanisms will collapse under new pressures.

In light of these interwoven complexities, it’s clear that the debate surrounding the SALT cap is more than just a numbers game; it’s emblematic of deeper systemic issues that lawmakers must confront with careful deliberation. Addressing these matters requires a shift in mindset—from fragmented, politically motivated reforms to comprehensive methodologies that prioritize sustainable governance and equitable taxation.

- Investment Planning For Students Yelofunding - January 8, 2026

- Commercial Real Estate Analysis And Investments Types - January 8, 2026

- 500 Million Reason to Pause: A Critical Look at Louisiana’s Tax Proposals - June 6, 2025

Leave a Reply