As we navigate the unpredictable terrain of municipal bonds, it’s essential to acknowledge the underlying resilience emerging within this market. Recent trends suggest a slight recovery for municipal bonds after significant fluctuations, primarily induced by changes in U.S. Treasury yields and overall market volatility. Despite an atmosphere characterized by uncertainty, the municipal bond sector shows promising signs of stability, hinting at a potential resurgence that could yield favorable returns for investors. This article delves into the intricacies of the current municipal bond environment, offering insights that reveal the complex interplay between market activity, issuance rates, and investor behavior.

Understanding Recent Market Movements

Notably, Wednesday’s trading session witnessed a stabilization in municipal bonds, as investor confidence began to wane regarding the previous week’s turbulent conditions. With U.S. Treasury yields experiencing a downward spiral, market participants encountered a series of subtle adjustments to yield ratios across various bond maturity ranges. The two-year ratio trended around 80%, while the strikingly high 30-year ratio hit 95%. Such movements indicate not merely a knee-jerk reaction to market fluctuations but rather a calculated response to ongoing economic dynamics, signaling a potential pivot to more favorable investment ratios for discerning buyers.

Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital, emphasized that a surge in bidding activity suggests a robust undercurrent of demand ready to seize the yield dislocations in the market. This suggests that investors are gradually regaining their footing, willing to explore opportunities that earlier seemed too risky.

The Impacts of Outflows on Market Dynamics

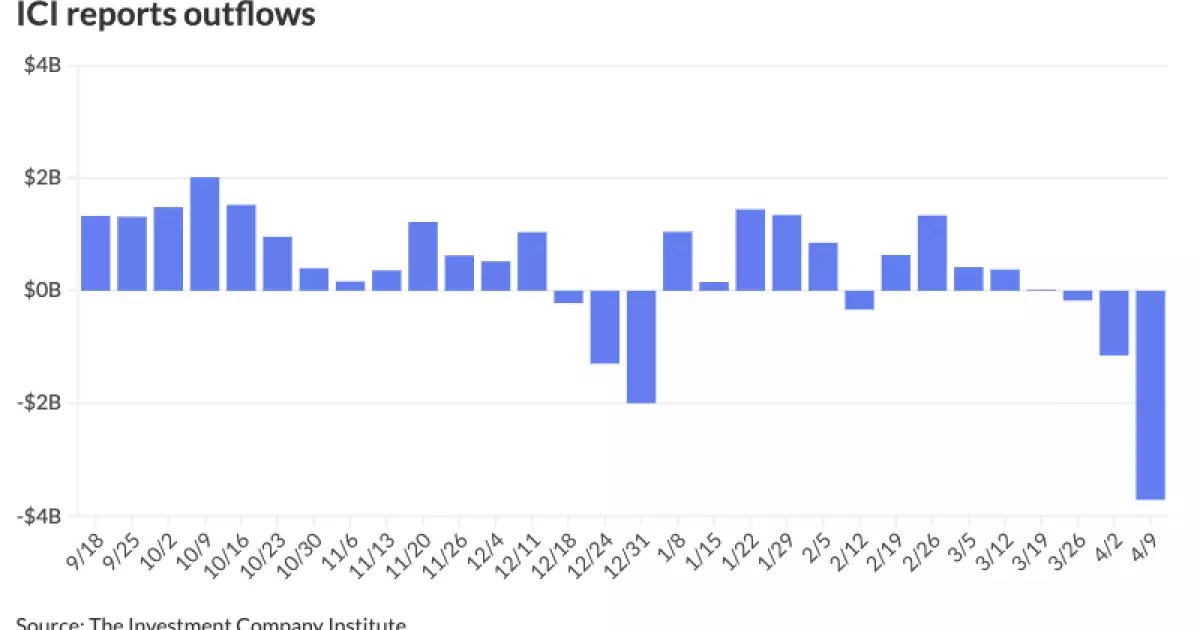

In a development that warrants scrutiny, the Investment Company Institute reported significant outflows of around $3.714 billion for the week ending April 9. This sharp sell-off followed a previous week’s outflow of $1.15 billion and underscores the challenges of investor sentiment in the current environment. Exchange-Traded Funds (ETFs) also witnessed a retraction of $1.402 billion, diverging starkly from earlier inflows.

Yet, in the context of these outflows, it’s crucial to recognize that the panic seemingly surrounding the municipal market may be somewhat overstated. This behavior can often trigger a reactionary cycle that substantially distorts market perceptions. Seasoned investors understand that such outflows can create conducive conditions for buying opportunities, as panic often leads to misaligned valuations that can become favorable for the astute investor.

Competitive Issuance and Emerging Opportunities

Amidst dwindling outflows and a shifting market stance, competitive sales for high-grade bonds from municipalities like North Carolina and Anne Arundel County reflect a trend of firm demand for high-quality issues. These transactions signified a renaissance of appetite for municipal obligations as yield curves begin to align more favorably. Even mega-deals from Connecticut and Massachusetts, estimated over $1 billion, highlight a resurgence of market interest that could prove vital for long-term equilibrium.

It’s also significant that transaction volume via the secondary market indicated a healthy $12 billion traded daily on average, higher than last year’s benchmarks. It shows that, despite some skittish investor behavior, the fundamental need for liquidity remains strong.

Yield Ratios: The Drawing Power for Investors

The recent rise in yield ratios presents a potent argument for investors reevaluating their positions within the municipal bond space. For instance, five-year yields hovering around 3.25% signal a considerable northward movement from last year’s lows and offer an appealing alternative to U.S. Treasuries at comparable maturities. As municipal bond yields strive to regain their footing post-early April spikes, the market appears to offer the promise of attractive relative value, with high-grade issues actively correcting from previous extremes.

Moreover, with ultra-short yields amplifying, the one-year AAA MMD yield exceeding 3.00% emphasizes the tactical advantages currently available, particularly for investors in higher tax brackets who can benefit from tax-equivalent yields that further entice them into the fold.

The Dichotomy of Market Behavior

An intriguing dichotomy exists as high-grade bonds continue to find favor among discerning investors, while riskier credits languish in relative indifference. AA-rated bonds capturing approximately 55% of all trades suggest a discernible quality bias among market participants seeking stability amid volatility. This preference for higher quality also raises questions about the resilience of lower-rated credits—which, despite their attractive yields, might struggle to attract attention in a climate marked by risk aversion.

Olsan’s insight into the shifting landscape of dealer-to-customer behaviors versus inter-dealer volume illustrates a market adjusting its own mechanisms, signaling a transition as buyers begin to shift prevalent dynamics and consider longer-term positions more seriously.

Even as the municipal bond market grapples with the challenges posed by recent volatility, there are palpable signs of opportunity and resilience beneath the surface. Investors who can decipher the nuances of this environment may well find themselves well-positioned to capitalize on the next wave of market recovery.

- Investment Planning For Students Yelofunding - January 8, 2026

- Commercial Real Estate Analysis And Investments Types - January 8, 2026

- 500 Million Reason to Pause: A Critical Look at Louisiana’s Tax Proposals - June 6, 2025

Leave a Reply