In today’s tumultuous financial landscape, where uncertainty reigns supreme, investors are grappling with a plethora of challenges that threaten to destabilize their portfolios. Amid rising tensions in global trade, concerns over Federal Reserve independence, and market volatility, one sector is managing to stand out: sports betting stocks. Recent insights from Roth Capital Partners illustrate a critical narrative that while many industries falter, the sports betting market exhibits resilience, making it a beacon of hope for investors looking for stability.

The Sturdy Fortress of Sports Betting Stocks

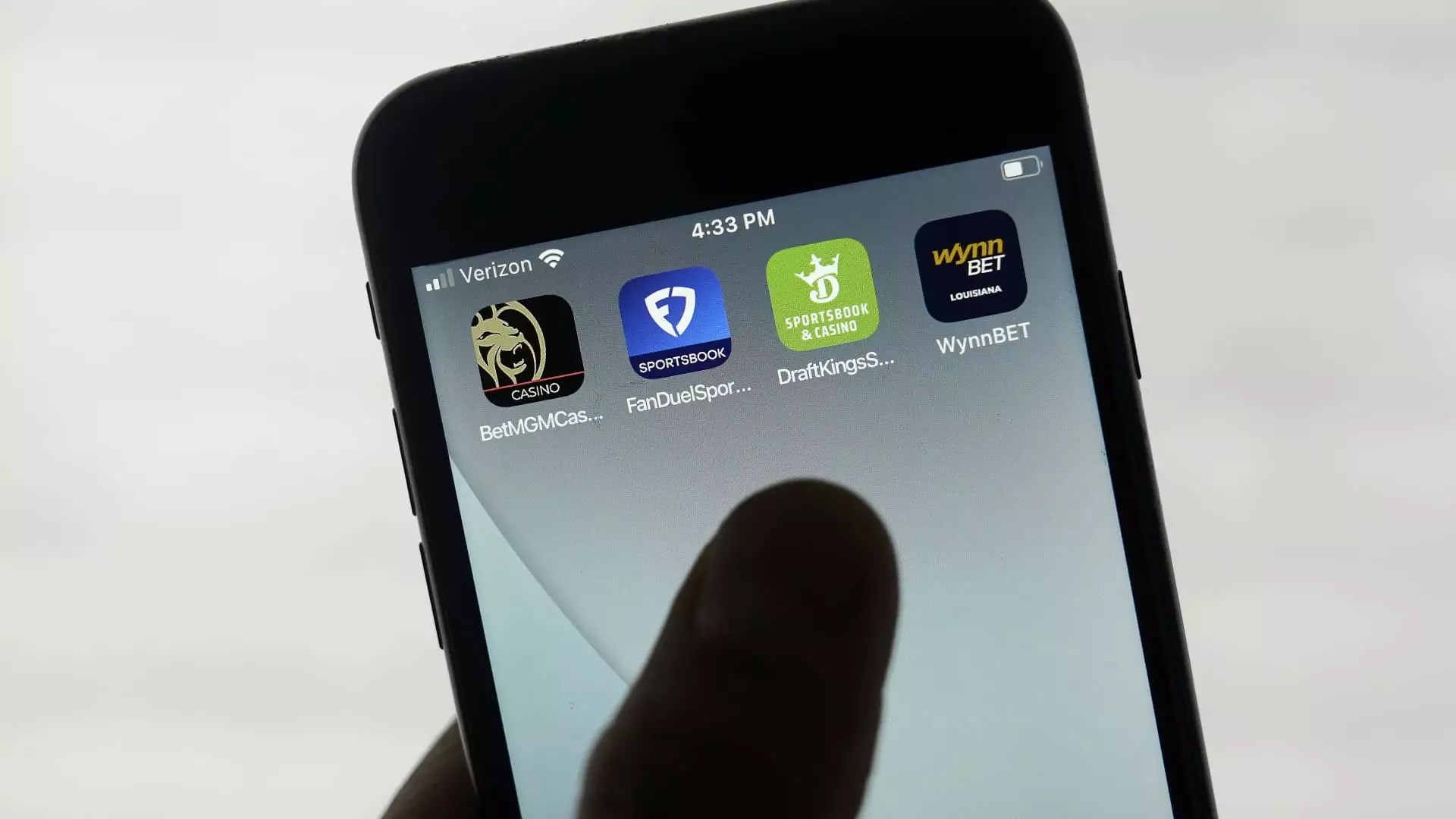

It’s easy to assume that economic downturns create a ripple effect across all sectors, but sport betting companies seem to counter this trend effectively. One must look at the data: the Roundhill Sports Betting & iGaming ETF (BETZ) saw a positive uptick of nearly 2% in April. In contrast, the broader S&P 500 index plummeted by about 9%. This divide isn’t merely a coincidence; it speaks to the robust foundation upon which these companies operate. Many may wonder why this sector is resilient when others flounder. The answer lies in its intrinsic nature: sports betting often flourishes during economic downturns as people seek affordable escapism.

Market Trends and Strategic Insights

JC O’Hara, a notable technical strategist at Roth Capital, indicates that while many equities struggle due to “trend damage” and inadequate support from the Federal Reserve, the sports betting sector is not only surviving but thriving. His observations reveal that the past support levels transitioning into resistance could create obstacles for other sectors. Yet here lies the paradox: while many stocks are struggling to regain momentum, prominent players in the sports betting arena are bucking the trend.

Investors would be wise to hone in on the underlying performance of companies like Flutter Entertainment, DraftKings, and Betsson. The positive reinforcement provided by the BETZ ETF showcases the potential for significant returns, especially as it is outperforming traditional stocks.

Outperformers in a Challenging Environment

When evaluating which stocks to consider for investment, one need not look further than Betsson. This company has demonstrated a phenomenal turnaround, breaking through previous price ranges established since 2016. Surging by more than 24% in just three months, Betsson serves as a powerful exemplar of how to break out of the norm during challenging times. Such performance is rare, and it’s a testament to the strategic positioning and operational effectiveness that sports betting firms have managed to achieve.

Similarly, VICI Properties, a gaming real estate investment trust, is on the cusp of significant growth potential. With expectations to challenge the $36 mark per share, its nearly 15% increase this year has investors paying close attention. This indicates that when it comes to real estate tied to gaming, there’s a strong prospect of long-term growth as well.

Understanding the Risks Amid Reward

However, the euphoria surrounding the sports betting stocks should not blind investors to potential risks. Not all companies in this sector have escaped the gravitational pull of broader market declines. DraftKings and Flutter Entertainment have seen dips of 22.4% and 18.3% respectively in recent months. This volatility reflects the overall economic climate while simultaneously reminding investors that no investment is free from risks, especially amid macroeconomic headwinds.

Understanding these risks doesn’t negate the potential rewards but should embolden investors to engage in careful risk management practices. This necessitates a balanced portfolio approach, where you weigh the strong performance of sports betting stocks against the realistic expectations given overall market sentiment.

The Bigger Picture and Future Outlook

As the macroeconomic environment remains fraught with tension and uncertainty, sports betting companies showcase resilience that traditional sectors often lack. Although volatility is still an omnipresent threat, the positive indicators continue to surface within the sports betting industry. The quick shifts in consumer behavior, combined with strategic adaptations in their operational infrastructure, enable these firms to maintain a competitive edge.

In a world marked by unpredictability, investors must assess the compelling trajectories of sports betting stocks while remaining vigilant about broader economic challenges. It’s not merely about riding the wave of favorable trends; it’s about recognizing a sector that appears equipped to withstand storms that threaten to derail others. As market analysts like O’Hara continue to uncover valuable insights, one can only hope to keep placing smart bets on companies poised for long-term success.

- Investment Planning For Students Yelofunding - January 8, 2026

- Commercial Real Estate Analysis And Investments Types - January 8, 2026

- 500 Million Reason to Pause: A Critical Look at Louisiana’s Tax Proposals - June 6, 2025

Leave a Reply