Recently, the municipal bond market has been emerging from a storm of uncertainty. On a given Thursday, there was a momentary shift that found municipal bonds holding their own, as mutual fund outflows slowed significantly. U.S. Treasury yields took a nosedive, providing a hopeful backdrop against which equities rallied. This peculiar play between municipal and Treasury yields, with the latter falling between six to ten basis points, raises fundamental questions about the resilience of municipal bonds in this economic climate. While the uptick in yields for munis, primarily between two to seven basis points across curves, signals a temporary recovery, the deeper struggles faced by these bonds cannot be ignored.

Love-Hate Dynamics of Munis

Seasoned investors and market participants are caught in a startling game of ennui when engaging with municipal bonds. Kim Olsan, a senior portfolio manager at NewSquare Capital, noted the oscillating affection for munis, suggesting that market sentiment fluctuates wildly with daily variables. This capricious interest is underlined by the recent announcement of a 90-day pause on certain tariffs, which has seemingly stabilized risk markets. Nonetheless, it’s crucial to question whether this love-hate dynamic can forge a lasting change. The positive reactions to tariff discussions may bring momentary relief, but the persistent losses over the month, currently pegged at a minus 1.67%, cast a long shadow over the potential for genuine recovery, especially when negative market sentiments remain palpable.

Increasing Uncertainty and Decreasing Demand

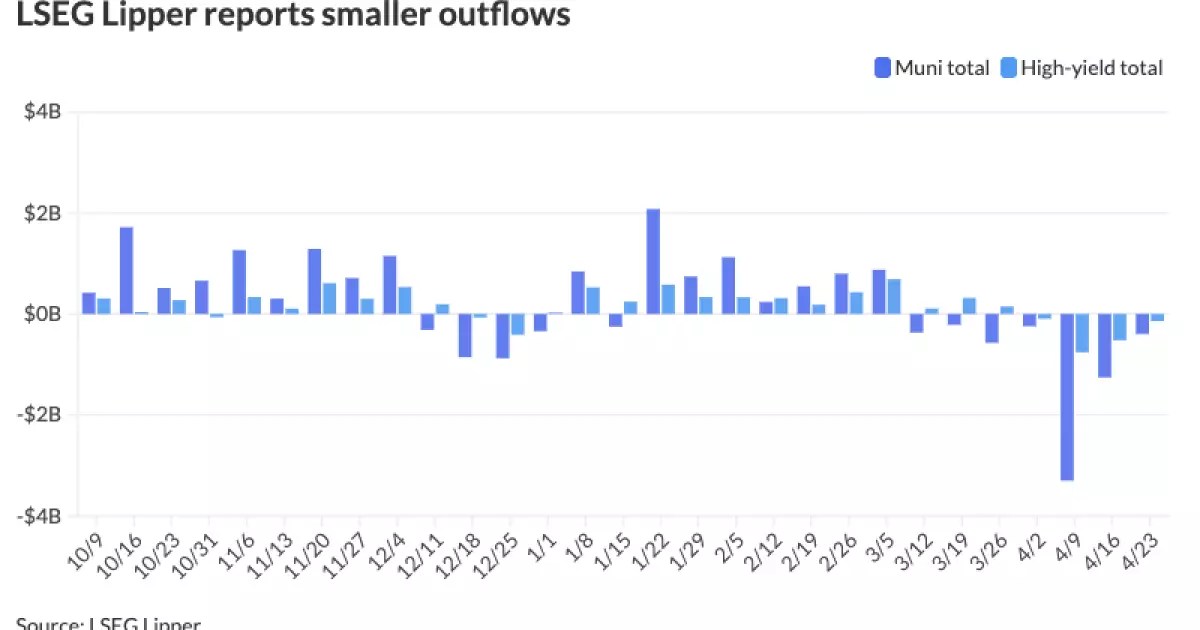

As municipal bonds grapple with challenges, several economists, including strategists at BlackRock, warn of supply-and-demand dynamics that are tightening the market. Though demand rebounded slightly in the wake of stable Federal Open Market Committee (FOMC) leadership discussions and eased U.S./China tariff tensions, the inflow of funds is far below acceptable levels. These tapering demands are further eroded by investor anxiety, spiraling outflows, and persistent market turmoil. Reportedly, over $397 million was siphoned from municipal bond mutual funds in just one week, anchoring fears that the market’s buoyancy may remain an elusive dream. Investors must remain critically aware of these complexities instead of being swayed by momentary rebounds.

Headwinds in Market Accessibility

The repercussions of diminished municipal bond liquidity throughout the market are worrying. As noted, a surge in outflows forced market participants to grapple with a supply shift that transitioned from net negative to net positive. Still, this transition does not automatically guarantee improved conditions. Lighter dealer participation is placing additional strains on market access, forcing issuers to reconsider their strategies in the face of impending tax law changes and a tight liquidity environment. The once-bullish outlook for new issues has begun to cave to the pressures of market access.

A Mixed Bag of Recent Offerings

The intricacies surrounding municipal bond offerings reveal an environment marked by both cautious optimism and price cuts. Recent transactions illustrate varying reactions across different states. For instance, Massachusetts saw its GO offering commendably tighten yields by five basis points, while Connecticut’s GO offerings faced notable reductions as intermediate and long maturities indicated troubled waters ahead. Although optimism emerges from the pricing of large state GO credits and the bullish results from select offerings, fluctuating demand underscores the fragility of the current market.

Red Flags in Fund Flows and Yields

Investor behavior regarding fund flows can offer rich insights into market sentiment and stability. The fact that tax-exempt municipal money market funds have seen a significant influx while high-yield funds bled substantial assets is a significant indicator of where conservative capital is gravitating. The rift between safe havens and those associated with risk necessitates careful analysis; not all bonds are created equal, and their potential attractiveness will continue to be critical in deciding market trajectories. As yield curves adjust—the average simple yield for municipal money-market funds has spiked to 3.52%, once again a testament to shifting market perceptions—it’s clear that volatility will remain a key theme.

The Call for Strategic Awareness

Navigating the complexities of the municipal bond market in its current state requires astute consciousness of underlying trends rather than remaining passive in the face of shifting dynamics. Whether it be through understanding yield adjustments, fund flows, or investor sentiment, staying politically engaged and contributing to policy discussions may ultimately help shape favorable conditions for future growth in the municipal bond sector. Amid fluctuating market conditions, lawmakers, investors, and financial institutions must collaborate to ensure that municipal bonds remain viable instruments for funding vital public services and infrastructure. As advocates of center-right liberalism, there’s a pressing need to re-evaluate tax policies, encouraging sustainable investment while fostering trust and stability within this essential financial ecosystem.

- Investment Planning For Students Yelofunding - January 8, 2026

- Commercial Real Estate Analysis And Investments Types - January 8, 2026

- 500 Million Reason to Pause: A Critical Look at Louisiana’s Tax Proposals - June 6, 2025

Leave a Reply